TOTL : Another Success Story

I invested in TOTL in February 2024. My purchase price was Rp 398 per share. Currently, TOTL shares are priced at Rp 680 per share, having previously reached Rp 860 per share last October. I will share my investment story in TOTL.

Company Overview

Total Bangun Persada, Tbk ($TOTL) has established a strong reputation in the construction industry since its inception in 1970. The company has been publicly traded on the Indonesia Stock Exchange since 2006 and focuses primarily on privately owned projects, with a particular strength in high-rise building construction that highlights its commitment to innovation and quality.

The company's diverse portfolio features a range of noteworthy projects, including commercial buildings, luxury apartments, contemporary office spaces, bustling shopping centers, respected universities, advanced hospitals, places of worship, cutting-edge television stations, secure data centers, and stunning resorts.

In 2023, TOTL successfully completed several significant projects, including Allianz Tower, Pakubuwono Residence, Regatta Apartments, The Hermitage, and Pondok Indah Residence, thereby reinforcing its position as a reliable partner in turning ambitious visions into reality.

Historical Performance

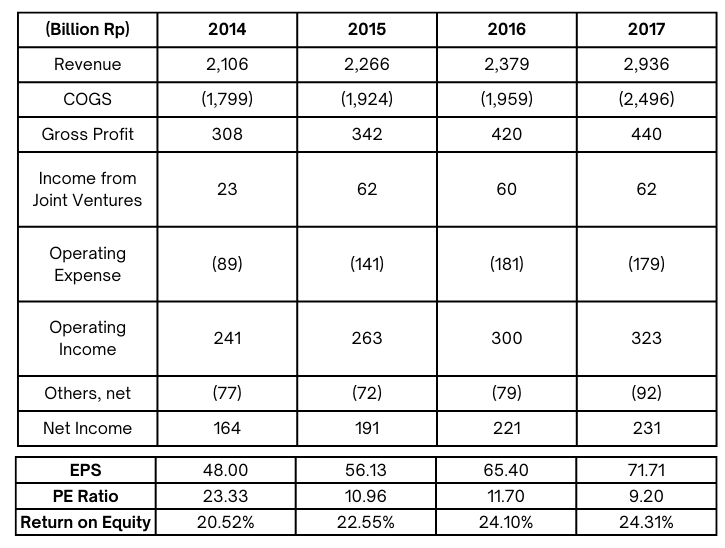

I will review TOTL's performance from 2014 to 2017, a period during which the company thrived. This timeframe coincided with a significant boom in property stocks that began in 2010 and reached its peak in 2017.

Between 2014 and 2017, TOTL's revenue grew from Rp 2.1 trillion to Rp 2.9 trillion, while net profit increased from Rp 164 billion to Rp 231 billion. At its best, TOTL's return on equity (ROE) exceeded 20%.

TOTL is not only a profitable company based on its balance sheet, but it is also financially healthy. The company has a very low interest-bearing debt, with a debt-equity ratio (DER) between 0-5%. Additionally, TOTL has sufficient cash to support its operations, reflected in a Quick Ratio of between 1.25 and 1.30. In terms of cash flow, TOTL consistently generates positive cash flow from its operating activities. The company is not capital-intensive; its capital expenditures (capex) average around 2% of annual revenue or approximately 19% of cash flow from operations. Analyzing its historical performance from 2014 to 2017 allows us to conclude that TOTL is a quality company.

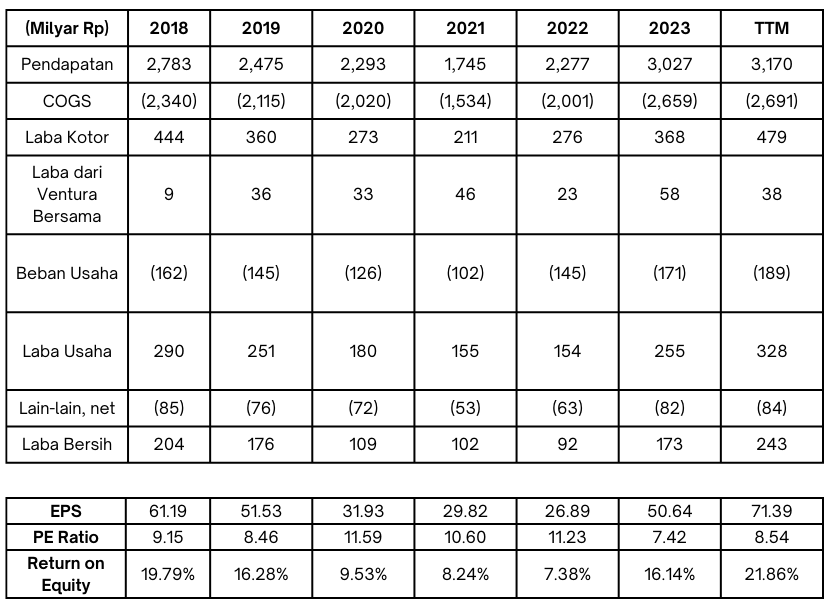

However, TOTL's performance began to decline in 2018 as the property boom came to an end. The situation worsened during the Covid-19 pandemic, with revenue dropping to its lowest point in 2021, reaching Rp 1.7 trillion. Net profit fell sharply from Rp 231 billion in 2017 to Rp 102 billion in 2021. Consequently, TOTL’s ROE, which had previously been over 20% annually, plummeted to 8.24%.

Despite a deterioration in operational performance due to generally poor economic conditions, TOTL has maintained a strong financial status. From 2018 until now, the company has had no interest-bearing debt and has relied on its sufficient cash reserves to support operations during unfavorable economic conditions.

TOTL's decline in performance is not due to a loss of competitiveness or market position; rather, it has been influenced by external factors, particularly the adverse economic conditions brought on by the pandemic. Large corporations also faced performance declines, leading to significant reductions in funds allocated for expansion or construction projects, which further impacted TOTL’s performance.

This decline in performance was reflected in TOTL's stock price, which fell approximately 60% from Rp 700-800 per share in 2017 to around Rp 300 per share in 2021

However, in 2023, TOTL's performance began to recover. Revenue reached Rp 3 trillion, and net profit increased to Rp 173 billion, even though margins remained stagnant and had yet to return to pre-pandemic levels. The Return on Equity (ROE) rose to 16%.

Despite the financial upturn, TOTL's stock price has not seen any movement since 2021, remaining in the range of Rp 300-400 per share.

I started analyzing TOTL in early 2024 and see it as a hidden gem for several reasons:

1. It is a solid company with healthy financials.

2. Its performance decline is not due to internal issues.

3. Financial performance has improved, yet the stock price remains unchanged.

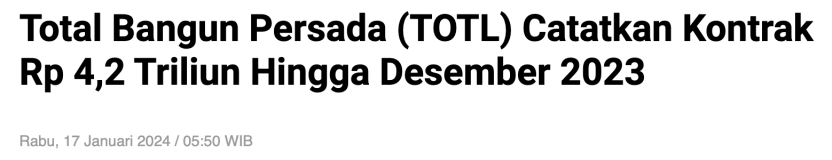

My confidence in TOTL grew further when I read that the company recorded contracts worth Rp 4.2 trillion throughout 2023, a significant increase from the Rp 2.8 trillion in contracts acquired in 2022. This growth suggests a considerable rise in revenue in the coming years.

Another positive aspect of TOTL is its regular dividend distribution, boasting an attractive average payout ratio of over 50%. I was disappointed not to receive the dividends distributed in 2023, which amounted to Rp 341 billion or Rp 100 per share. At the time, with TOTL’s share price at Rp 350, this resulted in a dividend yield of 28.5%. It was a missed opportunity, but there wasn't much I could do.

In 2024, TOTL distributed dividends again at Rp 40 per share. Given my purchase price of Rp 398, I’ve achieved a yield of 10%.

As of November 2024, TOTL has secured contracts worth Rp 4.67 trillion, an 11% increase from 2023. This indicates that the company’s revenue is expected to continue rising, and net profit could see even more significant growth in 2025 as profit margins improve.

This concludes my investment story with TOTL. I hope it inspires you.

Remember, the best investment opportunity arises when we purchase a good company experiencing a performance decline due to external factors.